When the Lincoln Financial Group sells its office park and campus in Concord’s North End (you can buy it for $6 million) and no longer has a presence as an employer in Capital City, it will close the books on more than a century of history of life insurance underwriting for a succession of companies.

When the Lincoln Financial Group sells its office park and campus in Concord’s North End (you can buy it for $6 million) and no longer has a presence as an employer in Capital City, it will close the books on more than a century of history of life insurance underwriting for a succession of companies.

This story began back in 1913 when a group of Concord’s leading citizens established the United Life & Accident Insurance Company, first located at 65 North Main Street in the heart of the city’s downtown. Among the early executives and directors were brothers S.W. and John B. Jameson, Benjamin W. Crouch, fire and casualty insurance executive Charles L. Jackman, and clerk of the new company. Allen E. Hollis, one of the city’s most prominent lawyers (Hollis became president of United life in 1923).The company seems to have had close connections with the Republican Party, as New Hampshire Governors Rolland H Spaulding (elected 1916) and Henry W. Keyes (elected 1918) were added to the company’s board of directors

The young life insurance company prospered, and had agents selling its product up and down the eastern seaboard. It kept most of its reserves in a non-interest bearing accounts in Concord banks, making the bankers happy. It also invested in railroad and municipal bonds and it bought up some 6% farm mortgages in Kansas and Nebraska. Then came the bust – the Great Depression and the Dust Bowl in the plains states. United Life suffered reversals as well, and even stopped spending money to procure new business.

Post World War II, the sun reappeared for the company, and in 1951, it moved to the former Durgin Silver Company building at 2 White Street (now home of UNH’s Franklin Pierce School of Law). New leadership on the board of directors came in the person of attorney Dudley W, Orr, and as president, Douglas B. Whiting.

By the late 50s, United Life had prospered to the extent that it became an attractive takeover target, and in a defensive move, Orr steered the company into a friendly takeover by Keene-based Peerless Insurance Company, over which Orr also exercised control. Soon, though, United Life eclipsed Peerless in value and Orr engineered a stock split that returned United Life to independence. Orr also hired a young Yale Law School graduate whose father had been Orr’s roommate at Dartmouth and Harvard Law School. His name was John F. Swope, and he would figure greatly in the company’s future.

United Life continued to grow and prosper, innovating a new product in the late 60s called ULAICO, which combined life insurance with securities ownership. Under its “Hampshire Plan,” agents sold insurance that became paid up in ten years along with an attractive mutual fund investment. It was a big success, and United Life was again a prime takeover target. Wanting to control its destiny as much as possible, the company hired a merger specialist, T. Benson Leavitt, and charged him with soliciting the best offer.

The suitor that fit turned out to be a New Jersey company, Chubb Insurance Company, whose chairman, Percy Chubb, was an alumnus of Concord’s St. Paul’s School. The fit between Chubb and United Life was a good one and the merger was consummated in the summer of 1971. That was the end of United Life’s corporate name, but hardly the end of the story.

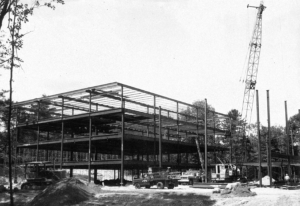

John Swope had helped steer United Life to its pinnacle of success, and in 1977 he was rewarded by being named President of Chubb Insurance Company. Soon thereafter, Chubb moved out of the White Street building and into a brand new “campus” called One Granite Place, uphill from the intersection of Rumford and Penacook Streets. A 96,000 square foot, 4-story building housed the growing company for only a few years and another 114,000 square foot building went up in 1985, all of this on a campus of 178 acres. Chubb named John Swope President of Chubb in 1977, and in 1982, the company adopted its new name, Chubb LifeAmerica. Chubb employed about 750 people in Concord at its peak in the 80s and early 90s.

John Swope had helped steer United Life to its pinnacle of success, and in 1977 he was rewarded by being named President of Chubb Insurance Company. Soon thereafter, Chubb moved out of the White Street building and into a brand new “campus” called One Granite Place, uphill from the intersection of Rumford and Penacook Streets. A 96,000 square foot, 4-story building housed the growing company for only a few years and another 114,000 square foot building went up in 1985, all of this on a campus of 178 acres. Chubb named John Swope President of Chubb in 1977, and in 1982, the company adopted its new name, Chubb LifeAmerica. Chubb employed about 750 people in Concord at its peak in the 80s and early 90s.

Concord gained from the presence of the Chubb operations within its borders. Swope and the Chubb leadership became active in helping the city gain a positive recognition in the arts world, giving generously to the Capitol Center for the Arts (where the big stage and auditorium were named the Chubb Theatre), the Concord City Auditorium, New Hampshire Public Radio, and more. The works of local artists were hung in the public areas of the Chubb buildings. And John Swope, and his wife, Marjory, became recognized community leaders. Swope says the company’s civic engagement reflected the commitment of United Life’s founders to public service.

Things went along generally well and the company grew until the early 90s when Wall Street pressured Chubb to return to its roots as a property and casualty company, and to sell off its life insurance business. Swope was forced out as president on December 31, 1994 and his place was taken by mergers and acquisitions specialist Theresa Stone, who engineered the sale of the life insurance company to North Carolina-based Jefferson-Pilot Corporation. Later, Jefferson-Pilot moved its headquarters to Nebraska, and in 2006, merged with Pennsylvania-based Lincoln National Life Insurance Company. That diversified to become Lincoln Financial Group, and a slow but deliberate downsizing of the Concord operations began. That leads us to the end of the road for the little life insurer known as United Life and Accident Insurance Company.

To read more about this story, and about several other insurance companies that grew as Concord progressed, see “Insurance: the business that replaced the railroad,” Chapter 14 of “Crosscurrents of Change: Concord, N.H. in the 20th Century” published by the Concord Historical Society. Buy it on this website or at Gibson’s Book Store or the Greater Concord Chamber of Commerce.

Photos courtesy of Lincoln Financial Group.